As a follow up to my post The Process of Trading One Trade at a Time here is the first step: Self Control.

Step 1: Self Control- Staying Calm In Any High Pressure Situation

You are the only thing in trading you can control. Therefore, in order to control your performance you must control yourself. "Am I in control of myself?" ought to be the first question you ask yourself before each trade. In order to answer that question you must be objective and give yourself feedback. Are you in the zone? Relaxed? Focused? Following your trading plan? Confident in your trading? Disciplined? Asking yourself these questions, thoroughly checking in on yourself, and giving yourself objective grades on how you are performing gives you a higher level of awareness that you need in order to properly analyze your trading. Master traders recognize when adjustments are needed and what adjustments to make.

Awareness

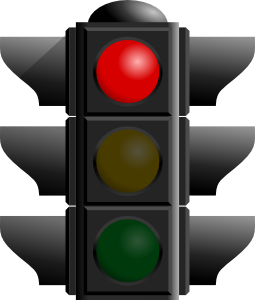

Think of awareness like an internal traffic light. Awareness is different than thinking; its more of a sensation or feeling. You don't really think when you approach a traffic light in your car; you see the light and resond to it. Likewise, when your trading don't think to much, just be aware of what is happening an respond accordingly.

When your trading well, your traffic light is green. You're in the "zone" and cruising right along. It's like when a basketball player is in rhythm and hits all his shots.

Other times you'll have a yellow light. You take a bad trade with poor risk reward. You let a losing trade make you chase other trades. You're not focused or you're rushing. You are in danger of to losing control.

When you hit a red light you're really struggling. You're focused to much on profit and not enough on risk. You're holding onto losing trades. You've lost control of your trading.

Learn to recognize when you have a green light and when you don't. Regaining control isn't difficult at the yellow light stage, but when you hit a red light, it becomes much tougher.

Unfortunately, when most traders see a yellow light they react the same way drivers do - they speedup to get though it. This is a common response to stressful situations. Its well known that athletes under pressure tend to perceive the game going faster and faster, so they go faster to keep up which can lead to mental mistakes.

You can get away with "disobeying" or not seeing your internal traffic light sometimes, but before long you'll end up a major wreck. Crashing and burning isn't fun. To avoid accidents, see the traffic light as you approach it. If it changes to yellow, keep your composure and make a sound decision about how to react.

On a future post I'll go over how to check your internal traffic light and how I train traders to keep the green light on.

http://seaofopportunity.blogspot.com/

*Special thanks to Option Radar, BMO Capital, MEB Options, LiveVolPro, CBOE, Option Monster, T.O.P. group, and all of the options desks and traders we work with to provide the option flow!

No position at this time. Position declarations are believed to be accurate at time of writing but may change at any time and without notice.

No comments:

Post a Comment