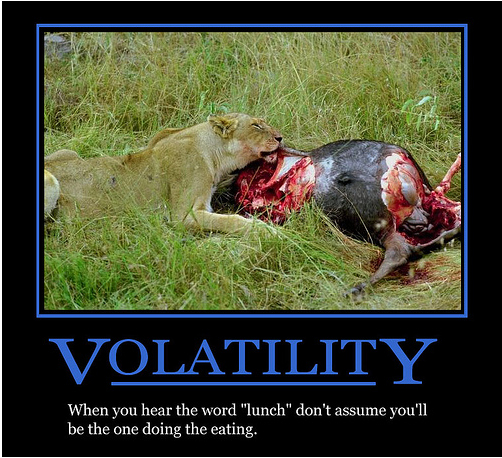

When discussing volatility, some traders may learn that they are not always talking about the same type of volatility. A volatility of 25% can mean a variety of things. To prevent any future misunderstanding, it will be helpful to define the various types of volatility.

Historical volatility, always a good starting point for option valuation, is compiled by examining wide varieties of time periods that graph volatility data.

Forecast volatility is simply that, a forecast. Just as there are various services that offer directional forecasts, there are forecasts for volatility as well.

Future volatility is what every trader would like to know. It is the volatility that would best describe the future distribution of prices for an underlying contract.

Seasonal volatility is a volatility that many traders encounter. One example would be the increased volatility traders encounter during earnings season. Another would be the volatility in commodity markets that arises from seasonal weather conditions.

We could go on and on about volatility but we'll just keep the basics here for now. If you have any questions please do not hesitate to ask.

http://seaofopportunity.blogspot.com/

*Special thanks to Option Radar, BMO Capital, MEB Options, LiveVolPro, CBOE, Option Monster, T.O.P. group, and all of the options desks and traders we work with to provide the option flow!

No position at this time. Position declarations are believed to be accurate at time of writing but may change at any time and without notice.

Which local stoch vol models do you find the best in modeling smile dynamics?

ReplyDeleteit wish it were that easy... the answer is that it depends on the name and market conditions... also depends on the books overall risk

ReplyDeleteFx buying and selling allows you to take a position on the changes in currency strengths over time, trading currencies and shopping for or promoting one against the opposite. Foreign exchange traders are looking for to make the most of fluctuations within the trade prices among currencies, speculating on whether one currency's price, like the pound sterling, will move up or down with regards to every other, which include the us greenback.With over 5 trillion dollars’ well worth of currencies traded globally every day, the forex marketplace is the maximum traded in the international, making it a especially liquid and dynamic marketplace. This excessive market liquidity approach that expenses can change hastily in response to news and short-term events, creating more than one trading possibilities for retail fx traders.

ReplyDeleteForex Signals

Best Forex Signals